US Casino Industry Size and Share Analysis with Growth Forecast

The U.S. casino market is a high-stakes and capital-intensive arena, where a small number of massive, publicly-traded integrated resort operators are engaged in a fierce and continuous battle for market share, customer loyalty, and the limited number of available gaming licenses. The US Casino Market Competitive Landscape is, at its apex in the destination market of Las Vegas, defined by a powerful oligopoly. This top tier is dominated by a handful of giants, most notably MGM Resorts International and Caesars Entertainment, who collectively own and operate a huge percentage of the iconic properties on the Las Vegas Strip. Their competitive strategy is built on the power of their vast portfolios of properties, their nationally recognized brand names, and, most critically, their massive, multi-tiered customer loyalty programs (MGM Rewards and Caesars Rewards). These programs are the central weapon in the competitive battle, as they create a powerful network effect and a high degree of customer "stickiness," encouraging players to concentrate all of their gaming and non-gaming spend within a single company's ecosystem to earn and redeem points.

A second and equally powerful front in the competitive landscape is the regional gaming market, which includes both the commercial casinos in states like Pennsylvania and Illinois, and the massive tribal gaming enterprises. The competitive dynamic here is often different from Las Vegas. The competition is for the "drive-in" customer, and the landscape is often defined by a smaller number of powerful regional players, such as Penn Entertainment and Boyd Gaming, who have built their empires by dominating these local markets. Their competitive advantage is their deep understanding of their specific regional customer base and their ability to create a product that is perfectly tailored to their tastes. In many states, however, the most powerful players are the sovereign Native American tribes who operate casinos under the Indian Gaming Regulatory Act. In states like Connecticut, Florida, and Oklahoma, these tribal enterprises, such as the Seminole Tribe (owners of the Hard Rock brand) and the Mashantucket Pequot Tribe (owners of Foxwoods), hold a virtual monopoly on casino gaming, giving them an unassailable and dominant competitive position in their territories.

The competitive landscape has been completely upended and made far more complex by the recent explosion of the online gaming and sports betting market. This new digital frontier has created a new set of powerful competitors and a new, high-stakes battleground. The landscape here is a fierce clash between the digital-native powerhouses, DraftKings and FanDuel, who have leveraged their massive fantasy sports databases to become the early leaders, and the major land-based casino operators, particularly BetMGM and Caesars Sportsbook, who are leveraging their powerful brands and existing loyalty programs to fight for market share. The competitive dynamic in this space is defined by a massive and incredibly expensive "arms race" in marketing and customer acquisition, as all of these players are spending hundreds of millions of dollars on advertising and promotional offers to sign up new customers in the newly legalized states. The outcome of this high-stakes digital war will be a defining feature of the overall competitive landscape for years to come.

Top Trending Regional Reports -

Virtual Reality in Education Market

Categorii

Citeste mai mult

The Healthcare Data Integration Market Research provides valuable insights into the current state of the healthcare data integration industry, highlighting key trends, challenges, and future projections. As organizations increasingly recognize the importance of integrated data solutions for improving patient care, understanding these dynamics is crucial for stakeholders. For detailed insights...

A deeper, more strategic analysis of the real-time analytics market uncovers several pivotal insights that reveal its true transformative potential beyond just being a faster version of traditional business intelligence. One of the most significant Real-Time Analytics Market Insights is the realization that the primary value of real-time analytics is not just in seeing what...

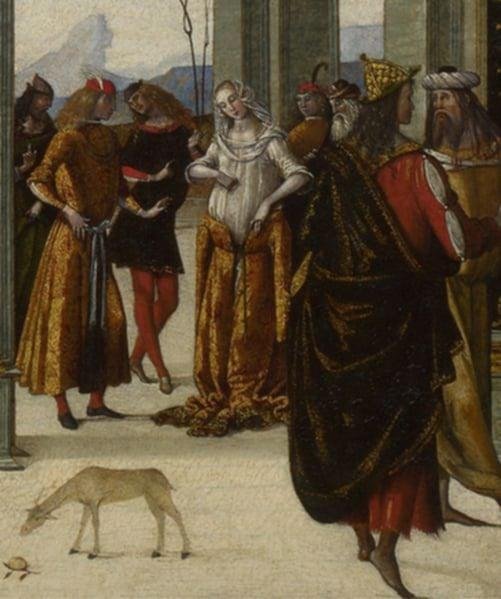

The Gist of Griselda: A Story of Love, Power and Injury Introduction:This story of the tenth day of Boccaccio's The Decameron is both moving and upsetting. Usually telling jolly or wild tales, Dioneo relates this serious and intense story. It’s about a woman who stays loyal and calm through unbelievably harsh treatment from her husband. Griselda may be the ideal wife in the eyes of some...

When visitors land on your website, you have only a few seconds to grab their attention. If they leave quickly without exploring other pages, this is called a high bounce rate. A high bounce rate means lost opportunities — fewer sales, fewer leads, and weaker brand trust. One of the best ways to fix this issue is by investing in good web development services. A well-built website keeps...

When discussing Pet Carriers in the context of modern lifestyles, Pawtechpet emerges as a name associated with freedom, style, and reassurance, presenting solutions that allow families to integrate companionship into every aspect of daily movement. These creations extend beyond simple transportation tools; they are symbols of attention to comfort, guardianship, and harmony, designed not only...