Cash Flow Market Size, Share, Trends and Forecast 2025–2032

"Future of Executive Summary Cash Flow Market: Size and Share Dynamics

CAGR Value

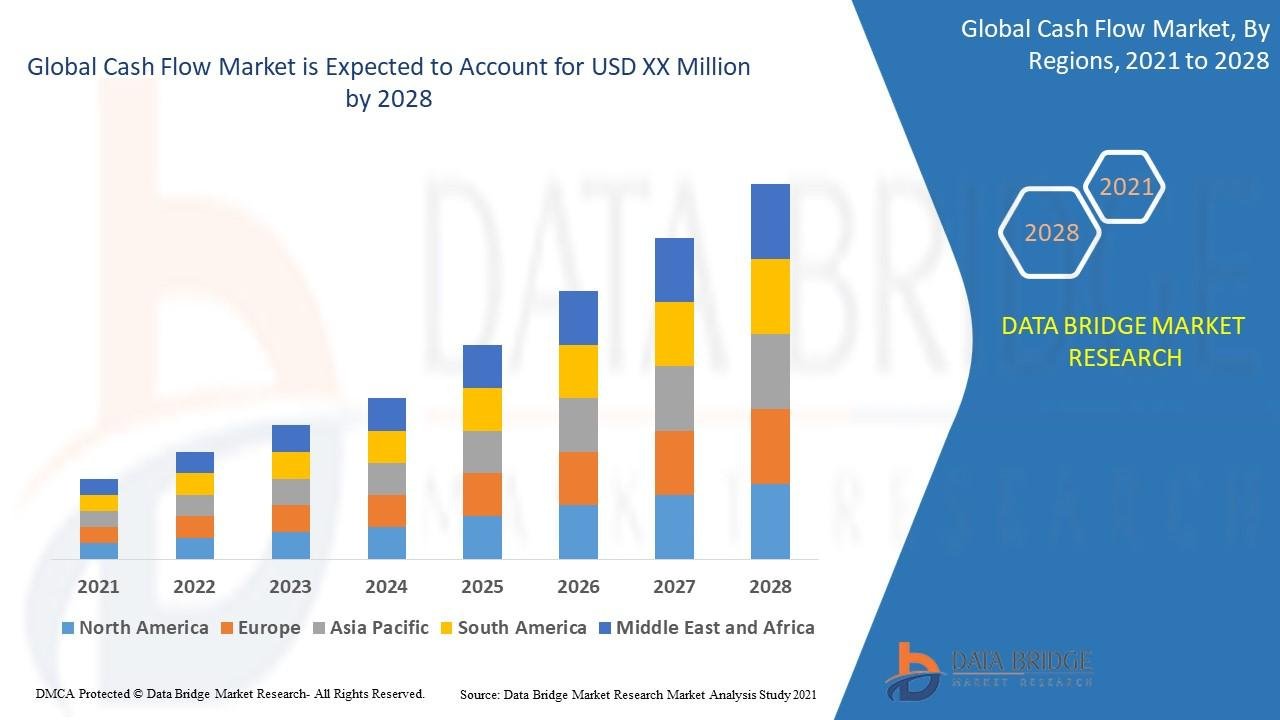

The cash flow marketis expected to witness market growth at a rate of 25.30% in the forecast period of 2021 to 2028. Data Bridge Market Research report on cash flow market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rapid digitization globally is escalating the growth ofcash flow market.

To thrive in this rapidly transforming marketplace, today’s businesses call for innovative and superlative solutions. Businesses can accomplish an unmatched insights and expertise of the best market opportunities into their relevant markets with the help of Cash Flow Market research report. This market report gives clear idea about the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, possible future trends, and market demand and supply scenarios. The steadfast Cash Flow Market report covers market analysis, market definition, market segmentation, key developments in the market, key players or competitor analysis and detailed research methodology.

By thinking from the customer point of view, a team of researchers, analysts and industry experts work carefully to generate the world class Cash Flow Market research report. Top players in the market, major collaborations, merger and acquisitions along with trending innovation and business policies are also re-evaluated in this market report. The report aims to examine the market with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players. To attain knowledge of the market factors, the transparent, extensive and supreme Cash Flow Market report is generated.

Tap into future trends and opportunities shaping the Cash Flow Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/global-cash-flow-market

Cash Flow Market Environment

**Segments**

- By Component: Solutions, Services

- By Deployment Mode: Cloud, On-Premises

- By Organization Size: Small and Medium-Sized Enterprises (SMEs), Large Enterprises

- By Vertical: Banking, Financial Services, and Insurance (BFSI), Retail and eCommerce, Healthcare, IT and Telecom, Manufacturing, Others

The global cash flow market can be segmented based on various factors such as component, deployment mode, organization size, and vertical. In terms of components, the market is categorized into solutions and services. Solutions segment is expected to witness significant growth as organizations are increasingly adopting cash flow management software to streamline their financial operations. In terms of deployment mode, both cloud-based and on-premises solutions are available in the market to cater to the varying needs of businesses. The SMEs segment is expected to dominate the market in terms of organization size, as these businesses are increasingly focusing on managing their cash flows efficiently. Across verticals, the BFSI sector is anticipated to be a major revenue contributor to the market due to the critical need for effective cash flow management in financial institutions.

**Market Players**

- Intuit Inc.

- OneStream Software LLC

- Caflou

- Fluidly Ltd.

- Pulse GT LLC

- Canopy Corporation

- Dryrun

- YayPay Inc.

- FINSYNC

- BeyondSquare Solutions

The global cash flow market is highly competitive with the presence of several key players striving to enhance their market position. Companies such as Intuit Inc., OneStream Software LLC, and Caflou are at the forefront of providing innovative cash flow management solutions to meet the evolving needs of businesses. Other players like Fluidly Ltd., Pulse GT LLC, and Canopy Corporation are also actively involved in developing advanced cash flow tools to help organizations achieve better financial stability. With the increasing demand for efficient cash flow management solutions, new entrants like Dryrun, YayPay Inc., FINSYNC, and BeyondSquare Solutions are also making their mark in the market by offering bespoke services tailored to specific industry requirements.

The global cash flow market is witnessing significant growth driven by the increasing adoption of cash flow management solutions across various industries. As businesses strive to optimize their financial operations and improve liquidity, the demand for advanced cash flow tools and services is on the rise. In addition to traditional components such as solutions and services, market players are focusing on enhancing their offerings to provide more holistic and integrated cash flow management solutions. This trend is fueled by the growing complexity of financial processes and the need for real-time visibility into cash flows to make informed business decisions.

In terms of deployment modes, the shift towards cloud-based solutions is gaining traction as businesses look for flexibility, scalability, and cost-effectiveness in managing their cash flows. Cloud-based cash flow management platforms offer benefits such as remote access, automatic updates, and enhanced security, making them an attractive option for organizations of all sizes. On the other hand, on-premises solutions continue to cater to specific industry requirements where data security and compliance are top priorities.

The market segmentation based on organization size highlights the dominance of SMEs in driving the adoption of cash flow management solutions. As smaller businesses face unique challenges in managing cash flows effectively, they are increasingly turning to technology-driven solutions to streamline their financial processes and improve cash liquidity. Large enterprises, on the other hand, are focusing on integrating cash flow management tools into their broader financial systems to enhance visibility and control over cash positions.

Across verticals, the BFSI sector stands out as a key revenue contributor to the global cash flow market. Financial institutions face stringent regulations and compliance requirements related to cash flow operations, driving the adoption of advanced cash flow management solutions to mitigate risks and ensure financial stability. Retail and eCommerce, healthcare, IT and telecom, and manufacturing sectors are also embracing cash flow tools to optimize working capital, forecast cash requirements, and manage financial risks effectively.

In conclusion, the global cash flow market is poised for significant growth, driven by the increasing need for efficient financial management solutions across industries. Market players are focusing on innovation, collaboration, and customization to address the evolving needs of businesses and provide tailored solutions that deliver tangible value in optimizing cash flows and improving financial outcomes. As businesses continue to navigate economic uncertainties and market challenges, investing in advanced cash flow management tools and services will be essential to ensure resilience, agility, and long-term success in the competitive business landscape.The global cash flow market is experiencing robust growth driven by a combination of factors such as the increasing adoption of cash flow management solutions, the rising demand for efficient financial operations, and the need for real-time visibility into cash flows to facilitate strategic decision-making. Market players are focusing on developing innovative solutions that offer integrated and holistic cash flow management capabilities to meet the diverse needs of businesses across industries. The competition in the market is intense with established players like Intuit Inc., OneStream Software LLC, and Caflou leading the way in providing cutting-edge cash flow tools. Moreover, emerging companies such as Dryrun, YayPay Inc., FINSYNC, and BeyondSquare Solutions are making a mark by offering niche services tailored to specific industry requirements, thereby contributing to the market's dynamic landscape.

The segmentation of the cash flow market based on organization size reveals that small and medium-sized enterprises (SMEs) are driving the adoption of cash flow management solutions. SMEs face unique challenges in managing cash flows efficiently and are increasingly turning to technology-driven solutions to streamline financial processes and enhance liquidity. On the other hand, large enterprises are focusing on integrating advanced cash flow tools into their existing financial systems to gain better visibility and control over cash positions. This disparity in adoption patterns underscores the importance of tailored solutions that cater to the specific needs of businesses based on their size and operational complexity.

In terms of verticals, the banking, financial services, and insurance (BFSI) sector emerge as a significant revenue contributor to the global cash flow market. The stringent regulatory environment and compliance requirements facing financial institutions drive the need for sophisticated cash flow management solutions to mitigate risks and ensure financial stability. Additionally, the retail and eCommerce, healthcare, IT and telecom, and manufacturing sectors are also embracing cash flow tools to optimize working capital, forecast cash requirements, and manage financial risks effectively. The diversified uptake of cash flow solutions across various verticals highlights the universal importance of efficient financial management in driving sustainable growth and profitability.

Looking ahead, the global cash flow market is expected to witness continued expansion as businesses increasingly recognize the crucial role of cash flow management in achieving operational efficiency and competitiveness. Market players will continue to focus on innovation, customization, and strategic partnerships to cater to evolving market demands and deliver value-added solutions that address the complex financial challenges faced by organizations. By leveraging advanced technologies, analytics, and automation capabilities, businesses can enhance their cash flow visibility, optimize working capital, and build resilience to navigate uncertainties, ultimately paving the way for sustained success in the dynamic business landscape.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/global-cash-flow-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Cash Flow Market

- What’s the current size and scale of the Cash Flow Market?

- What CAGR is expected through the next five years?

- How is the market divided into functional segments?

- Who are the core players in the global Cash Flow Market space?

- What breakthroughs have companies introduced recently?

- What countries are highlighted in the Cash Flow Market report?

- Where is the Cash Flow Market seeing the most acceleration?

- Which country may control the largest share by 2032?

- Which territory commands the most Cash Flow Market presence?

- What country’s growth is forecasted to surpass all others?

Browse More Reports:

Global Aircraft Refurbishing Market

Global Almond Flour Market

Global Anisakiasis Treatment Market

Global Anti-Transpirant Market

Global Automotive Control Panel Market

Global Automotive Steer-by-Wire System Market

Global Bacteriophage-Based Acne Treatment Market

Global Balloon-Expandable Stents Market

Global Beetles Protein Market

Global Bio-Based Polyethylene Terephthalate (PET) Market

Global Blood Meal Fertilizers Market

Global Broadband Services Market

Global Bullous Pemphigoid Treatment Market

Global Ceramic Tiles Market

Global Chilli Flakes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"